One important decision faced by parents when children with disabilities transition into adulthood is whether to pursue guardianship. Parents of children with special needs should understand that if their child will not be able to make their own decisions as an adult, the parents should take action before the child reaches the age of 18.

Considering Guardianship

One important decision faced by parents when children with disabilities transition into adulthood is whether to pursue guardianship. Parents of children with special needs should understand that if their child will not be able to make their own decisions as an adult, the parents should take action before the child reaches the age of 18. If no action is taken, the law will presume the individual has the mental capacity to make and communicate their own choices. If the parents may need to be involved in financial or medical decision making for the child, either a power of attorney or guardianship may be appropriate, depending on the child’s mental capacity level. If the child has the ability to understand the power of attorney document and choose a decision maker, in most cases it will be preferable to a guardianship proceeding.

Under Pennsylvania law, guardianships are a last resort, appropriate only when the individual’s ability to receive and evaluate information and communicate decisions is impaired so significantly that the individual is unable to manage financial resources or meet essential requirements for physical health and safety. When guardianship is appropriate, a court process, including a court hearing, is involved. Under Pennsylvania law, it is possible to obtain limited guardianship for certain decisions without the need for full guardianship.

Planning for Living Arrangements

One of the most basic but also difficult decisions for special needs families is where their adult child with disabilities will live. Many adults with special needs continue to live at home, while others can live independently or in a group home. This is a big decision, and it is important that families start thinking about it as part of the transition process. Finding an appropriate living situation outside the family home will consume a considerable amount of time, and determining how to pay for it takes careful planning.

Many adults with disabilities are able to pursue higher education or enter the workforce, but they may need special programs or accommodations. For other adults with special needs, lifelong care may be necessary, and the cost of such care looms large. Hazen Law Group can help you take advantage of available resources while protecting your loved one’s legal rights. Prudent financial planning combined with strategic use of all available benefits will result in a balanced plan to fund your child’s future.

The fact that these benefits are needs-based means that the individual must stay within strict income and resource limits to remain eligible. If the resources that the person owns go above this limit, they become ineligible for benefits, and if they receive other income, their monthly benefit amount is reduced.

Government benefits such as Supplemental Security Income (SSI) and Medicaid are important resources that are available for adults with disabilities. Since these programs are needs-based, it is essential for families to plan carefully to avoid jeopardizing their loved one’s eligibility.

Social Security

It is critical to understand the different types of Social Security disability benefits that may be available for disabled adult children. The Social Security Administration has two distinct programs, Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI). SSDI is a disability insurance program and is not needs-based. A disabled adult may qualify for SSDI based on his or her own work record or on the work record of a parent if the child was disabled prior to age 22 and the parent is receiving disability benefits, retirement benefits or is deceased. However, if the child’s parents are both living and are not receiving their own Social Security benefits, then disabled adult child benefits are not available. Assuming the individual with a disability has not worked enough to pay into the SSDI system on their own record, the cash payments they may be eligible for are SSI benefits, which are needs-based.

Medicare and Medicaid

Individuals who are eligible for SSDI qualify for Medicare after a two-year waiting period. Medicare is not means tested, but Medicare beneficiaries may need Medicaid benefits to fill in the gaps in Medicare coverage, and to qualify for waiver programs that provide home and community based supportive services for individuals with disabilities. Medicaid programs are needs-based. In Pennsylvania, SSI beneficiaries are automatically eligible for Medicaid, and this combination of benefits is often crucial to providing for the health care and living expenses of an adult with special needs.

Public benefits help your loved ones. Benefits that may be available include:

Resource Limits

The fact that these benefits are needs-based means that the individual must stay within strict income and resource limits to remain eligible. The 2017 resource limit for a single person is $2,000, though certain assets such as the house you live in and the car you drive are excluded. If the resources that the person owns go above this limit, they become ineligible for benefits, and if they receive other income, their monthly benefit amount is reduced. Of course, families naturally want to provide their loved one with more to live on than the small SSI benefit amount ($735 per month in 2017). This is where SSI and Medicaid planning become so important.

There are numerous complex issues that arise in the creation and management of SNTs, and the counsel of an experienced special needs attorney is indispensable.

Special needs trusts (SNTs) are a key tool in special needs planning, as they allow individuals with disabilities and their families to protect resources while maintaining eligibility for important government benefits.

All trusts involve funds being held by a trustee for the benefit of a beneficiary. In a special needs trust, the beneficiary is the individual with a disability. The trustee may be a trusted person such as a family member, or it may be a corporate or professional trustee. The key element of a special needs trust is that the funds held in the trust are not available to the beneficiary as a resource when determining eligibility for means-tested public benefits.

Special needs trusts are designed to supplement, not replace, the basic support provided by government benefits such as SSI and Medicaid. For this reason, they are also referred to as supplemental needs trusts. The trustee of a SNT can use the funds on a discretionary basis to provide for comforts and needs not covered by public benefit programs. This may include education, caregiving, medical services not covered by Medicaid, travel, entertainment and other supplemental expenses. If the trust beneficiary is eligible for SSI, the trust funds should not be used for food or shelter without consulting with a special needs trust attorney as doing so may reduce the beneficiary’s SSI income amount.

A third-party special needs trust is created using funds that do not come from the beneficiary. A self-settled or first-party special needs trust is created using the beneficiary’s own funds, which may be from an inheritance, the settlement of a lawsuit, or another source.

There are two major categories of special needs trusts: those funded with the beneficiary’s resources and those funded with the resources of a third party.

There are two types of trusts funded with the trust beneficiary’s resources: pooled trusts and first-party or self-settled SNTs. Trusts that are funded with the resources of a third party, such as a parent, are called third-party SNTs or supplemental needs trusts.

Third-party Special Needs Trusts

A third-party special needs trust is created using funds that do not come from the beneficiary, but from someone else, such as parents or other family members. The trust must state clearly that it is intended to provide for the disabled beneficiary’s supplemental needs, not to supplant public benefits. The trustee must have total discretion with regard to making payments to the beneficiary for supplemental needs. Upon the death of the trust beneficiary, any remaining trust assets are distributed according to the terms of the trust as determined by the individual who created the trust. The trust assets are not required to be used to repay public benefits or satisfy any other debts of the trust beneficiary.

Self-settled Special Needs Trusts

A self-settled or first-party special needs trust is created using the beneficiary’s own funds, which may be from an inheritance, the settlement of a lawsuit, or another source. A self-settled SNT must be created by a parent, grandparent or legal guardian, competent individual with disabilities or a court. The trust must be funded with the trust beneficiary’s assets and must be funded prior to the trust beneficiary turning 65 years of age. The trust must be for the sole benefit of the trust beneficiary. Upon the beneficiary’s death, funds in the trust must be made available to repay the state Medicaid agency for benefits received. As with third party SNTs, self-settled SNTs must be irrevocable and the trustee must have complete discretion to distribute funds for the disabled beneficiary’s supplemental needs.

Pooled Trusts

Pooled trusts are managed by non-profit organizations as trustee for the benefit of multiple people with disabilities. A separate account is established for each beneficiary of the trust, but for management and investment purposes the assets are pooled. Pooled trusts are funded with the beneficiary’s own resources. Upon the death of the beneficiary, the remaining trust balance does not have to be used to repay Medicaid as long as the remaining balance is retained by the trust for the benefit of other individuals with disabilities. Funds can be added to a pooled trust after age 65, but doing so may create a period of ineligibility for Medicaid benefits.

For beneficiaries with the mental capacity to manage their own finances, ABLE accounts fill a much-needed void and give these individuals an option to save resources but also remain in control of them.

The federal Achieving a Better Life Experience (ABLE) Act accounts are a new tool that allow people with disabilities that occurred prior to age 26 to save for the future without endangering their eligibility for government benefits such as SSI and Medicaid.

The ABLE Act

The ABLE Act was enacted in December 2014, providing tax and other benefits to people with disabilities who use ABLE savings accounts to pay for qualified disability expenses. The accounts are similar to 529 college savings accounts. ABLE accounts will be offered by states and several states now have active accounts. Individuals are not limited to the ABLE account established in their state of residence, but rather can compare investment options and fees and choose the account that offers the best deal. Pennsylvania’s ABLE account is expected to be operating early in 2017.

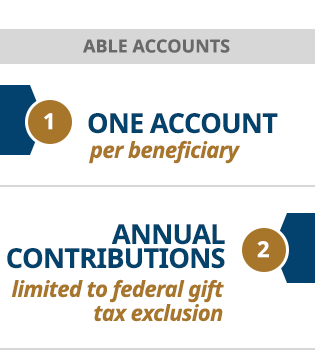

ABLE accounts are a valuable new planning tool, but they are not a replacement for special needs trusts. There can only be one account per beneficiary and annual contributions are limited to the federal gift tax exclusion amount, currently $15,000. Withdrawals from the account are tax-free if they are for qualified disability expenses. This is a more restrictive standard than that which applies to distributions from SNTs. ABLE accounts are not countable for Medicaid and SSI eligibility purposes, and as long as the account balance does not exceed $100,000.

Some potential pitfalls with ABLE accounts are that funds in the account may have to be used to repay Medicaid benefits on the death of the account beneficiary. For this reason, often a third-party SNT will be a preferred choice when planning for a family member with a disability. With ABLE accounts, family members must communicate to be sure multiple accounts are not created, and to make sure the annual contribution and account maximum limits are not exceeded.

Despite these potential downsides, there are circumstances when ABLE accounts will be a valuable planning tool. ABLE accounts will primarily benefit individuals with disabilities who have excess resources of their own. For beneficiaries with the mental capacity to manage their own finances, ABLE accounts fill a much-needed void and give these individuals an option to save resources but also remain in control of them.

In addition to providing financially for your child with special needs, your estate plan should address who will care for your child after you are gone. If the child has a power of attorney designating the parents as agents, the power of attorney should also name successor agents if the parents are not able to serve.

All parents should have an estate plan in place to help provide for their children. For parents of children with special needs, a proper estate plan will be more complex, but it is even more indispensable.

One fact that should be made clear to everyone who may be intending to leave an inheritance to an individual with special needs, is that if the individual is a beneficiary of government benefits such as SSI and Medicaid, leaving money to them directly could jeopardize their eligibility. Because such benefits are means-tested, resources held in the name of the person with a disability must be kept below certain limits. A third-party special needs trust is usually the best solution for parents and grandparents who wish to provide for their family member with special needs. A third-party SNT allows family members who wish to leave property for the disabled person’s benefit to do so in a way that will not interfere with eligibility for public benefits, but that will provide a safety net of supplemental resources to provide for the needs of the trust beneficiary.

Last Will and Testament

When creating your estate plan, you may use a will or a revocable living trust to leave property to a third-party special needs trust. It is also possible to make the trust a designated beneficiary of retirement accounts, annuities and life insurance policies. It is very important to coordinate your account ownerships and beneficiary designations with your estate planning documents. Failing to do so may result in your estate plan not being implemented in the way you intended. It is very important to work with your special needs attorney or estate planning attorney to coordinate your beneficiary designations with your estate plan in the way that minimizes taxes and accomplishes your goals.

Successor Agents or Guardians

In addition to providing financially for your child with special needs, your estate plan should address who will care for your child after you are gone. If the child has a power of attorney designating the parents as agents, the power of attorney should also name successor agents if the parents are not able to serve. The power of attorney may also include a succession provision allowing the parents to choose a successor if they are no longer able to act. If the parents have been appointed as legal guardians for the child, or if the child is a minor, then the estate plan should nominate the person or persons whom the parents would like to succeed them in that role.